Today, expectations for companies to align their business with environmental, social, and governance (ESG) standards are higher than ever. Organizations are coming under pressure to improve their awareness of sustainability issues and their impact on economic value — with many struggling to do so.

In response, the European Union recently passed new ESG regulations that may force some companies to restructure their business and revisit compliance efforts in a major industry shake-up.

While most organizations publish ESG sustainability reports, one of the current challenges with voluntary ESG reporting is the lack of consistency in the information shared. Businesses can choose which ESG reporting framework to use and what they want — or don’t want — to disclose. This makes it harder for investors and stakeholders to compare companies regarding ESG risks and impacts.

One of the biggest challenges is data. A recent Dun & Bradstreet survey found 47% of companies do not have enough data and 46% are unable to validate and trust their ESG data. These issues can have operational and financial consequences — from regulatory non-compliance, to fines, and a weakened global supply chain.

Effective Jan. 2024, companies operating in the European Economic Area (EAA) —including those based in the U.S. — must be more detailed in their sustainability reporting due to the Corporate Sustainability Reporting Directive (CSRD) policy.

What is the Corporate Sustainability Reporting Directive ESG regulation?

The new CSRD regulation introduces significant changes to what companies must report regarding ESG performance, what data they’ll be required to obtain, and what processes they must have in place.

Issues will cover environmental, social, human rights, and governance factors. Companies must audit and disclose both the effect their business has on the globe and the impact of these concerns on their business.

CSRD does not only require EU companies but also non-EU companies with activities in the EEA to file annual reports alongside their financial statements. These reports must be prepared according to the European Sustainability Reporting Standards (ESRS).

On July 31, 2023, the European Commission adopted the first set of ESRS. With this soon becoming law, it will apply directly to all 27 European member states but not to the U.K. These standards go far beyond most mandatory and voluntary ESG reporting frameworks in its scope and granularity.

What are the new ESG regulations?

The goal of the reporting directive set by the European Commission is to achieve the Green Deal’s target: transform the EU into a modern, resource-efficient, and competitive economy by ensuring:

- No net emissions of greenhouse gases by 2050

- Economic growth decoupled from resource use

- No person and no place are left behind

The directives aim to define a common reporting framework for non-financial data. Together, the CSRD and ESRS require companies to:

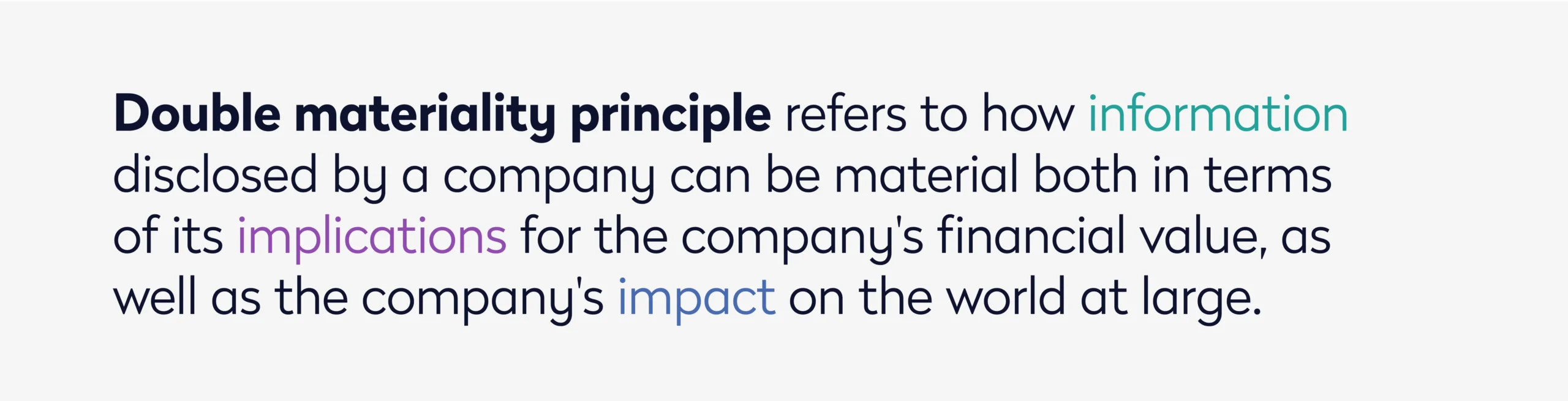

- Perform materiality assessments on each sustainability topic to determine which information they should report by applying the double materiality principle

- Report on the material impacts, risks, and opportunities (IRO) identified in their business operations, those of its group, and those of its upstream and downstream value chain

- Provide metrics and targets for material sustainability topics and connect those to their financial reports

- Audit their sustainability disclosures by an independent third-party auditor before filing with the relevant authority

These new regulations update corporate sustainability reporting under the 2014 Non-Financial Reporting Directive (NFRD) — a regulatory framework requiring sizeable public interest entities to report on sustainability performance. With advanced rules that extend beyond the continent, CSRD is much more ambitious than NFRD.

Which companies will be affected?

With the CSRD replacing the NFRD, it expands the number of companies that must comply by nearly four times. While the 12,000 companies reported under the NFRD, almost 50,000 companies will be impacted by the CSRD — making up 75% of business in the EEA.

The directive is mandatory for in-scope companies:

- Companies listed on regulated markets in the EU

- Companies that meet at least two of the following criteria: More than 250 employees, net turnover of over 40 million euros, or total assets exceeding 20 million euros

- Non-EU companies with at least one subsidiary in the EU and a net turnover of more than 150 million euros

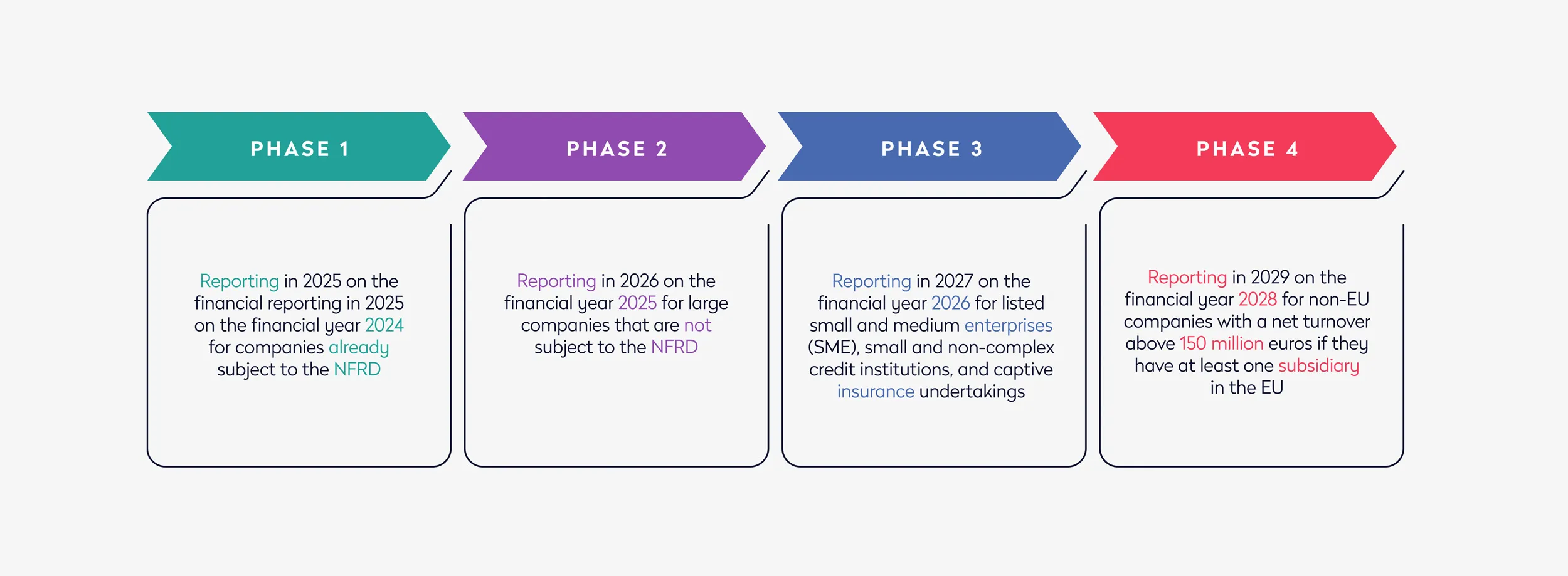

What are the four phases of CSRD implementation?

- Phase 1: Reporting in 2025 on the financial reporting in 2025 on the financial year 2024 for companies already subject to the NFRD

- Phase 2: Reporting in 2026 on the financial year 2025 for large companies that are not currently subject to the NFRD

- Phase 3: Reporting in 2027 on the financial year 2026 for listed small and medium enterprises (SME), small and non-complex credit institutions, and captive insurance undertakings

- Phase 4: Reporting in 2029 on the financial year 2028 for non-EU companies with a net turnover above 150 million euros if they have at least one subsidiary in the EU

Why CSRD and ESRS matters to American companies

As mentioned, CSRD applies to non-EU companies with substantial activity in the EEA, including a physical presence. 31% of these companies affected are American.

It is important to note that CSRD reporting covers the business at a consolidated level, not just at the EU-based subsidiary or branch level. What does this mean? U.S. companies with significant turnover in the EU must publish sustainability information covering their entire operations, not just their EU operations. Even companies with a single EU operation must apply the new rules for the 2028 fiscal year.

These ESG reports will need to be prepared according to one of the following:

- Standards applicable to the EU companies within the scope of CSRD and ESRS

- Separate ESG standards for non-EU companies that have yet to be published – these standards are expected to be adopted by the European Commission by the end of Jun. 2024

- Standards that are deemed equivalent by the European Commission

Of these three options available to American parent companies, only the draft ESRS disclosure requirements have been published so far. They are still deciding which sustainability reporting standards used outside the EU will be considered equivalent.

The truth is, there are still many unknowns about the exact CSRD reporting requirements for U.S. companies operating in the EEA, and the upcoming year will bring some answers to many awaited questions.

How can companies prepare for CSRD ESG reporting?

The CSRD is a highly detailed piece of legislation that raises many questions. But one of the most common is: How can companies prepare for the new ESG reporting?

Supporting the new CSRD policy requires a diverse set of skills, and companies must ensure their employees have the right expertise to address the regulation adequately. Key areas of focus should be:

- Program management helps manage ESG programs and stakeholders

- Information technology works to implement reporting tools to streamline data collection and reporting processes

- Data collection identifies the relevant data sources and collects the data from internal and external operations and databases

- Data analysis uses statistical tools to interpret data and identify ESG risks, opportunities, impacts, and trends according to ESG calculation standards

- Reporting leverages writing and editing skills to prepare and present the ESG data clearly and consistently that aligns with CSRD requirements

Employees may require additional compliance training and support regarding ESG reporting guidelines and standards. Also, as part of your strategy, determine which tasks will be assigned to internal staff versus external service providers. This will help with the preparation.

Summary

Soon, investors, consumers, and policymakers will use CSRD to check corporate non-financial information in line with sustainability reporting standards. The new policy seeks companies to increase their disclosure of environmental and social risks and opportunities. It will also ensure that investors have detailed information on the ESG performance of their investments.

The European Union’s CSRD won’t just affect local companies; all companies operating in the EAA need to get up to speed with CSRD — when they will be affected and what they need to do to prepare. This new directive will transform sustainability around the globe by rewriting ESG reporting.

Go deeper. Read our guide to optimizing ESG performance with technology.