Capital planning is a key part of operational efficiency, ensuring the strategic alignment of large-scale projects and investments with organizational goals. By systematically identifying, evaluating, and prioritizing capital expenditures, organizations can focus on the initiatives that drive growth. But making these decisions is difficult without reliable data. Without an accurate view of today’s big picture, it’s impossible to properly plan for the future.

By implementing a modern unified workplace platform, organizations streamline and strengthen facility and maintenance management workflows. They can also take the data they’re automatically capturing and leverage it for better capital planning.

What is capital planning, why is it important, and how is it related to operational efficiency?

Capital planning is a strategic process that involves the systematic identification, evaluation, and prioritization of capital investments and expenditures. These investments typically include significant investments of time and money for the acquisition, construction, renovation, or replacement of long-term assets such as buildings, equipment, and infrastructure. Capital planning aligns investments with the organization’s strategic objectives, financial capabilities, and operation needs, aligning efforts with goals, ensuring a strong return on investment (ROI), reducing risks, and satisfying stakeholders.

Operational efficiency means spending only the necessary time, money, or effort to reach goals. With careful capital planning, organizations can ensure they see maximum benefit from their large-scale projects.

Strategic alignment

Effective planning ensures that every capital investment aligns with the organization’s long-term strategic goals and objectives. Organizations can focus their resources on initiatives that drive growth and support sustainability. Alignment helps organizations maintain a clear and consistent direction, which is crucial for long-term success. This allows organizations to stay focused and move in the right direction.

Financial efficiency

Making informed, data-driven decisions means companies can maximize ROI and optimize the use of financial resources. Careful analysis of potential investments allows organizations to identify the most cost-effective and profitable opportunities, improving their financial health by ensuring every dollar spent contributes to its overall mission and vision.

Risk mitigation

Risk mitigation is a critical aspect of capital planning and involves identifying and addressing potential issues early to reduce the risk of financial losses and operational disruptions. By conducting thorough risk assessments and implementing proactive measures, organizations can safeguard their investments and ensure smooth operations. A proactive stance not only protects the organization from unforeseen challenges but also builds a foundation for future growth.

Stakeholder satisfaction

Effective capital planning ensures facilities and services meet the needs and expectations of all parties involved, including employees, customers, and investors. By engaging stakeholders in the planning process and considering their feedback, organizations can create solutions that are both effective and well-received. A focus on stakeholder satisfaction not only enhances the organization’s reputation but also fosters a strong and supportive community around initiatives.

Which industries tend to have the most capital planning?

Capital planning is a critical process in several industries, especially in those that include enterprise-level organizations and involve significant physical infrastructure, long-term investments, and high operational costs.

Construction and real estate

Both the construction and real estate industries involve large-scale projects with significant upfront costs and long-term financial implications. Capital planning is essential for managing the construction of new buildings, renovations, and maintenance of existing properties. For example, real estate developers need to plan for the costs of land acquisition, construction, and ongoing maintenance to ensure that projects are financially viable and meet regulatory standards.

Manufacturing

Manufacturing facilities require substantial investments in machinery, equipment, and infrastructure. Capital planning helps in managing these investments, ensuring that production lines are efficient and up to date. A manufacturing plant may need to plan for the replacement of aging machinery, the installation of new production lines, or the upgrade of safety systems to comply with industry standards.

Healthcare

Healthcare facilities, such as hospitals and clinics, require significant capital investments in medical equipment, technology, and infrastructure. Capital planning is crucial for maintaining high standards of patient care and operational efficiency. So, a hospital may need to plan for the purchase of new medical equipment, the renovation of patient rooms, and the implementation of advanced healthcare information technology systems to improve patient outcomes and operational efficiency.

Energy and utilities

Energy and utility companies require significant capital investments in power generation, transmission, and distribution infrastructure. Capital planning helps in managing these investments to ensure reliable and sustainable energy supply.

For example, utility companies need to plan for the construction of new power plants, the upgrade of transmission lines, and the implementation of smart grid technologies to improve efficiency and reliability.

Government and public services

Government agencies and public service organizations are responsible for a wide range of infrastructure, including schools, public buildings, and public transportation systems. Capital planning is essential for maintaining and improving these facilities to serve the public effectively. City governments need to plan for the construction of new schools, the renovation of public buildings, and the expansion of public transportation networks to meet the needs of growing populations.

Facility management

Because facility management includes the maintenance, operation, and improvement of buildings and infrastructure, it often involves significant upfront costs and long-term financial planning. Capital planning is essential for managing the construction of new facilities, renovations, and the maintenance of existing properties. For example, an office building might need to plan for the costs of constructing a new wing, renovating outdated facilities, and ensuring ongoing maintenance to ensure that the projects are financially viable and meet regulatory standards.

What are the steps for capital planning?

Because of the time and money involved, capital planning is a meticulous, multi-step process.

- Identification of needs: Evaluating the current state of existing assets to identify areas that require maintenance, upgrades, or replacement followed by anticipating future needs based on growth projections, regulatory changes, and technological advancements

- Financial analysis: Determining the available budget and allocating funds to various capital projects

- Cost-benefit analysis: Evaluating the financial impact of each potential investment, including initial costs, ongoing maintenance, and long-term benefits

- Funding sources: Identifying and securing funding sources, such as internal budgets, loans, grants, and partnerships

- Risk assessment: Identifying potential risks associated with each capital project, such as delays, cost overruns, and regulatory changes

- Mitigation strategies: Developing strategies to mitigate these risks, such as contingency plans and insurance

- Stakeholder engagement: Engaging with stakeholders, including management, employees, and regulatory bodies, to gather input and ensure alignment with organizational goals

- Project management: Overseeing the execution of capital projects to ensure they are completed on time and within budget

- Performance tracking: Monitoring the performance of completed projects to assess their impact and identify areas for improvement

For example, a hospital can use capital planning to decide whether to invest in a new wing. This process includes assessing the current state of the existing facilities, evaluating the financial impact of the investment, considering potential benefits to patient care, and ensuring compliance with healthcare regulations. The hospital would also engage with stakeholders, such as the board of directors and medical staff, to gather input and secure support for the project.

What are the challenges of successful capital planning?

Capital planning involves a wide range of people, processes, technologies, and priorities. Facility and workplace leaders often face several specific challenges that can make this process even more difficult.

Budget constraints

Capital planning can be a significant challenge for organizations due to limited resources and competing priorities. Many organizations operate with constrained budgets, making it difficult for them to allocate sufficient funds for all necessary capital projects. Budgets often need to cover a wide range of operational and maintenance needs, leading to tough decisions about where to allocate funds. For example, a hospital might have a tight annual budget for its aging infrastructure with multiple critical maintenance needs. Deciding which projects to fund and which to defer is a constant challenge.

Long-term versus short-term needs

Balancing the long-term and short-term is a common challenge in capital planning. Predicting future needs and trends can be challenging, especially in rapidly changing environments. For example, a facility manager might know that a building requires immediate repairs to the roof, but there’s also a long-term need to upgrade the electrical system. Balancing these within the budget is a significant challenge.

Employee and user needs

Meeting the diverse requirements of different users and departments can be a significant challenge. Different users and departments may have different needs and preferences, making it difficult to create a unified capital plan. And gathering and integrating user feedback into the capital planning process can be time-consuming and complex. For example, badge data and employee feedback might indicate a need for more collaborative spaces, but there’s also demand for more private offices.

Data quality and availability

In the Workplace Innovator podcast episode “Enterprise Asset Management, Capital Planning & FM in Higher Education,” guest Cameron Christiansen, director of asset management at Princeton, explains how data is a basic building block of effective decision-making.

“Data gives you information, and that information turns into knowledge. Knowledge gives you understanding of the issue and understanding allows you to make wise decisions.”

— Cameron Christensen, Director of Asset Management for Facilities Operations at Princeton University

Inaccurate or incomplete data related to occupancy numbers, utilization rates, and maintenance records make it much more difficult to know where to best invest resources. Siloed data is just as much of a problem. When every department has its own sets of separate data, the organization cannot see the current big picture and find trends that help predict the future.

Because many of these challenges are all connected to data, their solutions center on finding the right sources of data.

What are important sources of data for better capital planning?

Organizations need a wide range of data sources to make informed and strategic decisions. From facility condition assessments to maintenance logs, each piece of data plays a crucial role in ensuring that capital investments are both necessary and impactful. By understanding and leveraging these data sources, organizations can optimize their resources, reduce risks, and achieve their long-term goals more efficiently.

Market and industry trends

Understanding market and industry trends is essential for making informed decisions about future investments. Organizations can leverage this data to gain insights into emerging technologies and best practices, helping facility and workplace managers stay ahead of the curve. By aligning capital investments with industry trends, organizations can improve their competitiveness and efficiency. For example, industry trends might suggest a growing demand for smart building technologies, and this insight can lead to a capital investment in Internet of Things (IoT) sensors and smart building management systems.

Facility condition assessments (FCAs)

FCAs are crucial for understanding the current state of buildings and infrastructure. The assessments provide detailed information about the condition of various systems and structures, helping to identify areas that need immediate attention, such as repairs or upgrades. By prioritizing capital investments using these assessments, organizations can ensure that their facilities remain in optimal condition. For example, an FCA can reveal that the HVAC system is nearing the end of its useful life, necessitating a capital investment to replace it.

Maintenance records

Maintenance records are essential for tracking the history of repairs, replacements, and routine maintenance activities. The records provide valuable insights into the performance and reliability of building systems, helping to predict future maintenance needs and costs. The data allows for better budgeting and planning, ensuring efficient resource allocation. For example, maintenance records could show that a roof has required frequent repairs over the past five years, indicating a need for a capital investment to replace it.

Energy consumption data

Energy consumption data is vital for identifying areas where energy efficiency can be improved. By analyzing this data, facility managers can pinpoint systems or areas that are consuming too much energy and make informed decisions about capital investments in energy-efficient technologies, leading to significant cost savings. For example, energy consumption data could reveal that a building has significantly higher energy usage compared to others in the same facility, suggesting the need for an investment in energy-efficient lighting and HVAC systems.

Occupancy and utilization rates

Occupancy and utilization data provide valuable insights into how spaces are being used to help optimize space usage, reduce waste, and inform decisions about future expansions or renovations. By understanding how different areas are utilized, facility managers can make more informed decisions about how to allocate resources. For example, occupancy data can show that the conference rooms in an office space are underutilized, while the open workspaces are often overcrowded, suggesting the need to reconfigure the space to better meet the needs of employees.

Financial reports and budgets

Financial reports and budgets provide a clear picture of the financial health of the organization and the available resources for capital projects. These documents help leadership make informed decisions about which projects to prioritize, ensuring that capital investments are both necessary and feasible. For example, financial reports might show a surplus in the maintenance budget, which the organization reallocated to fund the installation of new security systems.

Regulatory and compliance data

Regulatory and compliance data ensure that capital investments meet legal and safety standards. This data helps avoid costly penalties and ensures that facilities are safe and compliant. By staying informed about regulatory requirements, organizations can make proactive investments that prevent future issues. For example, compliance data might reveal that a building was not meeting the latest safety standards for fire exits. They made a capital investment to upgrade the fire safety systems to meet these requirements.

Historical data and trends

Historical data and trends provide a long-term perspective on the performance of facilities and systems. Organizations can leverage this data to predict future needs and inform strategic planning, ensuring that capital investments are aligned with the organization’s long-term goals. By analyzing historical data, facility managers can make more informed decisions about future investments. For example, historical data might show a consistent increase in the number of visitors to a facility over the past two years, and the trend supports the need to expand parking facilities.

How does a unified digital workplace and facility management platform help with capital planning at facilities?

For a facility management department, the built-in features help teams prioritize, assign, and schedule work, control inventory, and enforce standard operating procedures and accountability. And because many of the features also automate the capture of critical data, they directly support capital planning.

Asset registry

An asset registry is a comprehensive inventory of all physical assets, including their location, condition, maintenance history, and life cycle data. There’s also detailed information on the age, value, and performance of each asset.

The asset registry is a key component in capital planning as it provides a clear and detailed overview of the organization’s physical assets. The data helps to make informed decisions about capital investments, such as when to replace or upgrade assets, and how to allocate funds for maintenance and repairs. By having a complete and up-to-date asset registry, organizations can better manage their asset lifecycle, optimize maintenance schedules, and ensure that capital investments align with the organization’s strategic goals.

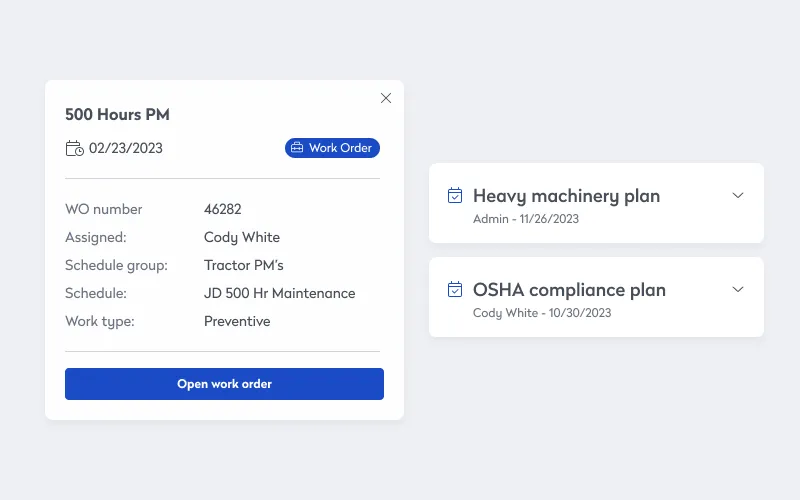

On-demand and preventive maintenance work order management

Work order management systems collect data on maintenance requests, work order statuses, completion times, and the costs associated with each task.

All this data is crucial for capital planning because it provides insights into the maintenance needs of facilities and assets. By analyzing this data, organizations can identify patterns and trends in maintenance costs, predict future maintenance needs, and allocate capital resources more effectively. For example, if certain pieces of equipment consistently require expensive repairs, the data can inform decisions to replace or upgrade them, which reduces long-term maintenance costs.

Parts and materials inventory control

Parts and materials inventory control systems contain the stock levels, usage rates, and costs of all parts and materials used in maintenance and operations. There’s additional data on supplier information, lead times, and reorder points.

By analyzing which parts are being used most frequently and which assets require the most work, organizations can identify which are likely to require replacement. For example, if a particular piece of equipment consistently requires expensive and frequent part replacements, it may be more cost-effective to plan a capital project to replace or upgrade that equipment. A proactive approach helps in reducing unexpected downtime and maintenance costs, ensuring that capital investments are targeted and effective.

Visitor management

Visitor management systems collect data on visitor check-ins and check-outs, including the purpose of the visit, the areas accessed, and the duration of the visit. The data can also include visitor feedback and any incidents or issues that occurred during their visit.

Organizations might treat this data as indirect or secondary. It provides context or additional insights that can help support or inform a primary analysis, even though it may not be directly related to the focus of your investigation or planning. While visitor management data may not seem directly related to capital planning, it can provide valuable insights into the usage and performance of facilities. For example, if certain areas of a facility are frequently visited, it may indicate a need for additional resources or improvements in those areas. Visitor feedback can also highlight issues that need to be addressed, such as inadequate facilities or security concerns, which can inform capital investment decisions.

Energy usage tracking

Energy usage tracking systems collect data on electricity, water, gas, and other energy consumption metrics. The data includes historical and current utility bills, energy efficiency metrics like kWh per square foot, and the performance of specific equipment such as HVAC and lighting. The system also tracks peak demand times and renewable energy production, along with results from energy audits and assessments.

This data is crucial for capital planning because it helps organizations identify areas of high energy consumption, revealing opportunities for targeted efficiency improvements and cost savings. Accurate consumption data aids in budgeting and forecasting utility costs, ensuring financial soundness. It also helps calculate the ROI for energy efficiency projects, such as upgrading systems or installing renewable energy sources. Understanding energy usage can help meet regulatory requirements and qualify for incentives, while also supporting sustainability goals and operational efficiency.

Customer success story: SDG&E’s transformation to integrated capital project planning and management

San Diego Gas & Electric (SDG&E) is a leading utility company serving Southern California with a long history of providing reliable energy services to its customers. However, as the company grew and the complexity of its operations increased, it faced significant challenges managing its capital projects effectively, including:

- Inefficient cost control

- Lack of transparency

- Difficulties with project tracking

SDG&E’s legacy systems were unable to keep up with the growing demands of capital projects, and the company struggled with fragmented data, manual processes, and a lack of real-time visibility into project costs and progress. Frequent budget overruns and project delays hurt the company’s financial health and affected its ability to meet customer needs and regulatory requirements.

Implementing Eptura

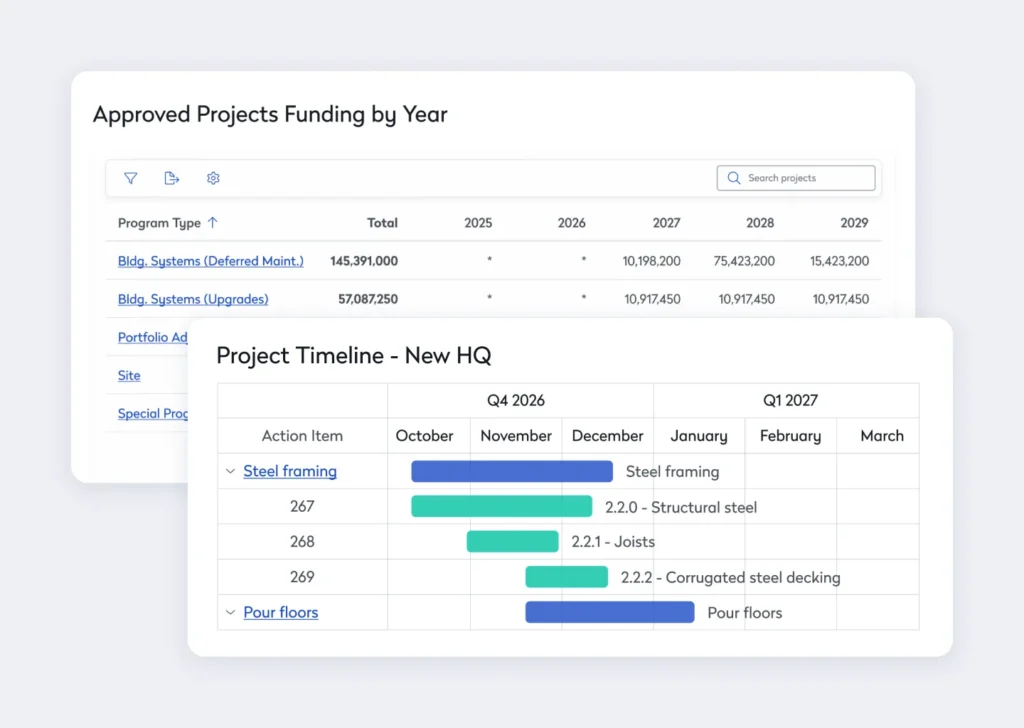

SDG&E decided to implement a centralized, highly integrated IT platform using Eptura. The primary goal was to improve the management of capital projects by integrating space and preventive maintenance data with SAP financials.

The company wanted to use the platform for:

- Accurate and real-time reporting: The legacy systems were unable to provide accurate and timely financial data, leading to frequent discrepancies and delays. Eptura’s integration with SAP financials ensures that all financial data is up-to-date and accurate, enabling better cost control and reporting.

- Comprehensive views of project costs and progress: The lack of a unified platform made it difficult to track project costs and progress effectively. Eptura provides a single source of truth, offering a comprehensive view of all project-related data, which enhances transparency and accountability.

- Alignment of financial data and facility management: The integration of space and preventive maintenance data with financials ensures that capital investments are well-informed and strategically aligned. This alignment is crucial for making data-driven decisions and optimizing resource allocation.

The new platform has helped deliver significant benefits for SDG&E. One of the most notable improvements is the increase in the annual budget for capital projects. Over a five-year period, the budget has grown from $5-7 million to over $40 million, and the substantial increase is a direct result of the improved data, processes, and reporting capabilities provided by the new system.

Additionally, the transformation has normalized long-range project planning and budgeting, reducing the risk of budget overruns and project delays, ensuring that resources are used more efficiently.

The platform’s ability to integrate multiple data sources has also streamlined operations, reduced costs, and improved the overall efficiency of capital project management. For example, the integration of space and preventive maintenance data has enabled SDG&E to identify and prioritize critical maintenance needs, reducing the likelihood of unexpected breakdowns and costly emergency repairs.

Read the full report to discover how SDG&E moved from one-year cycles to a three-year planning horizon.