Every organization needs to be careful about compliance, but there’s even more pressure for those operating in highly regulated industries, where there are more rules and falling out of compliance comes with tougher consequences.

What are highly regulated industries?

The amount and types of regulations vary across industries due to the unique risks and potential impacts. The differences reflect the need to address specific concerns and protect stakeholders, ensuring that each industry operates responsibly.

A highly regulated industry is one that is subject to extensive rules and oversight by government agencies or other regulatory bodies. These regulations are there to ensure safety, protect consumers, maintain ethical standards, and promote fair competition. Regulations can cover a wide range of areas, including production processes, product quality, environmental impact, and employee safety.

Heavily regulated industries include:

- Healthcare: Ensure patient safety, data privacy, and the quality of care. Key regulations include the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union.

- Finance: Maintain market stability, protect consumers, and prevent fraud. Regulations include the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Sarbanes-Oxley Act, and the Basel III framework for banking regulations.

- Energy and utilities: Secure environmental protection, safety, and reliability. Regulatory bodies like the Federal Energy Regulatory Commission (FERC) in the U.S. and the European Union Agency for the Cooperation of Energy Regulators (ACER) play crucial roles.

- Manufacturing: Safeguard worker safety, product quality, and environmental sustainability. Regulations cover areas such as workplace safety standards, product testing, and environmental impact assessments. Regulatory bodies like the Occupational Safety and Health Administration (OSHA) in the U.S. and the European Chemicals Agency (ECHA) play vital roles in enforcing these standards.

Staying compliant is essential for businesses in these industries to avoid legal penalties and reputational loss while maintaining consumer trust.

What are the connections between compliance and facility and maintenance management in highly regulated industries?

Healthcare is highly regulated, and much of the compliance focuses on patient safety and data privacy. In the financial industry, compliance includes protecting data and ensuring financial stability and trust. But there are also many areas of compliance for these industries that are directly connected to workplace, facility, and maintenance management.

For example, the Health Insurance Portability and Accountability Act (HIPAA) requires healthcare facilities to implement physical safeguards to protect patient health information, including:

- Secure storage of medical records

- Controlled access to areas where sensitive information is stored

- Regular maintenance of security systems

Facility managers must ensure that all equipment and systems used related to the storage and transmission of patient data are regularly maintained and updated to meet HIPAA standards, including:

- IT infrastructure

- Security cameras

- Physical locks

In finance, the Dodd-Frank Wall Street Reform and Consumer Protection Act requires secure and compliant physical environments. Financial institutions must ensure that their data centers and other critical facilities are secure and meet regulatory standards. Facility teams must complete regular maintenance of security systems, data storage facilities, and other critical infrastructure is essential to comply with the Act.

In addition to these industry-specific requirements, an organization’s facilities are required to meet environmental and Occupational Safety and Health Administration (OSHA) regulations.

How does a digital solution help with compliance?

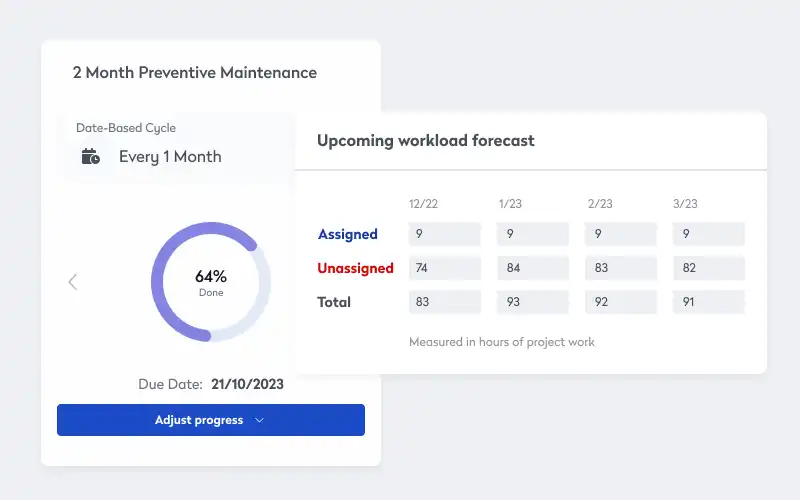

Meeting regulatory compliance with manual data processes is challenging because it often leads to inefficiencies and increased risk of errors. Manual processes are time-consuming and prone to human error, which can result in data inaccuracies, missed deadlines, and incomplete documentation. And manual systems make it difficult to maintain consistent and up-to-date records, especially as regulations evolve, risking non-compliance issues, increased scrutiny from regulatory bodies, and potential legal penalties.

Improved accuracy with centralized data

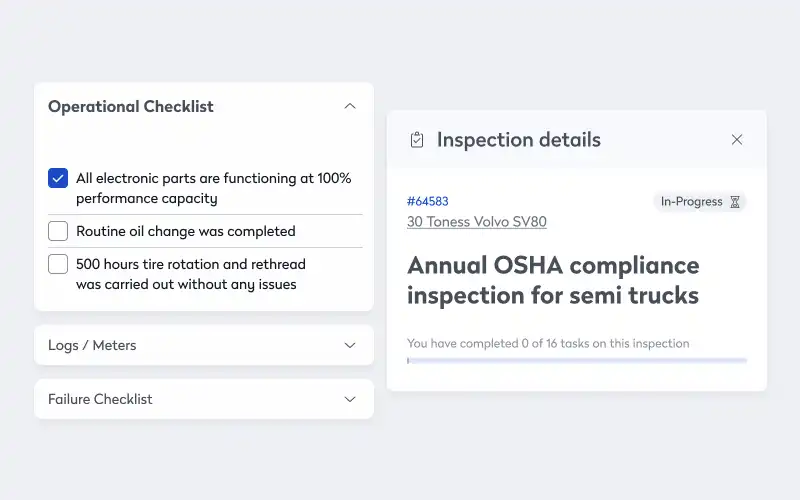

By automating data entry and reporting processes, organizations can reduce the risk of human error, ensuring that compliance documentation is both accurate and consistent. For example, a manufacturing company can use a digital system to automatically log safety inspections and employee training records, minimizing the chance of data inaccuracies and ensuring that they have recorded all required information. Accurate and consistent data is crucial for passing audits and maintaining regulatory compliance without the need for time-consuming manual corrections.

And digital solutions provide centralized data management, another key advantage. By centralizing all compliance-related data in one place, organizations can easily access and manage the information they need. For instance, a healthcare provider can use a digital platform to store all their compliance reports in a single, secure database, simplifying the audit process, as auditors can quickly and easily access all relevant information, reducing the time and effort required for audits and minimizing the risk of oversight. Centralized data management not only streamlines the compliance process but also enhances overall organizational efficiency.

What is the connection between highly regulated industries and enterprise-level companies?

Compliance is an especially important concern for larger companies.

First, they’re more likely to face more regulation. Highly regulated industries tend to have a lot of large companies because of the significant financial and operational challenges of compliance. One key reason is economies of scale. Larger companies can distribute the costs of meeting regulatory requirements over a broader base of production or services, making it more economically viable. And these companies have more robust risk management systems. They can better handle the financial and operational risks associated with non-compliance, which can be substantial. The ability to manage risk effectively gives them a competitive edge.

Another important factor is the established reputation and trust that larger companies often enjoy. Consumers and other stakeholders tend to prefer doing business with well-known, reputable firms that have a proven track record of compliance and reliability. Another contributing factor is how the high costs and complexity of regulatory compliance tend to act as significant barriers to entry for smaller companies. It is difficult for new, smaller players to enter the market and compete with the established larger companies.

Second, large organizations have multiple locations, which creates an additional set of compliance challenges, including:

- Consistency across locations: Ensuring that all facilities are following the same compliance standards and procedures can be difficult, especially if they are in different regions with varying regulations.

- Coordination and communication: Coordinating compliance efforts and communicating changes or updates to all facilities can be complex and time-consuming.

- Regulatory variations: Different locations may be subject to different regulations, making it difficult to manage compliance across all facilities.

- Resource allocation: Allocating resources effectively to manage compliance across multiple locations can be challenging, especially with limited personnel.

Again, the solution is implementing compliance software. The only difference is it needs to be an enterprise-level platform.

Compliance and communication

Improved collaboration and communication are essential for effective compliance management, especially across multiple locations. For example, a pharmaceutical company with facilities in different regions can use a digital platform to coordinate between its legal, quality assurance, and operations teams. This ensures that all departments are aligned and working together to meet regulatory standards, regardless of their physical location.

Digital platforms can facilitate real-time communication and collaboration, making it easier to share updates, documents, and compliance checklists, helping align efforts and ensuring that all aspects of compliance are being addressed effectively, reducing the likelihood of oversight or miscommunication.

Compliance and scalability

Scalability and flexibility are also critical for compliance. For example, as a retail chain expands into new regions, a digital solution can easily scale to accommodate new regulations and increased data volumes, ensuring that the company can maintain compliance without the need for significant manual adjustments or additional resources.

And digital compliance management system can automatically update policies and procedures to reflect new regulatory requirements, ensuring that all locations are following the same standards. Consistency is vital for maintaining a uniform approach to compliance, which helps in reducing the risk of non-compliance and ensures that all facilities are operating under the same guidelines.

Scalability also plays a role in managing regulatory variations across different locations. For instance, a multinational corporation operating in multiple countries can use a digital solution to handle diverse regulatory frameworks. The system can provide location-specific compliance checklists and guidelines, ensuring that each facility adheres to the appropriate regulations. Built-in flexibility allows the company to adapt quickly to changes in regulations, maintaining compliance without the need for extensive manual intervention. By centralizing compliance management, the company can ensure that all locations are following consistent procedures, which is crucial for maintaining a strong compliance culture.

Customer success story: Mastering maintenance and compliance in energy

Gas Field Specialists, Inc. (GFS), already famous for its specialized services and commitment to safety and compliance, faced significant challenges that threatened their ability to meet regulatory requirements and optimize their operations.

The company relied on manual systems, which often led to delays and errors. And they lacked a reliable system for managing equipment calibrations and technician certifications, increasing the risk of non-compliance, regulatory penalties and unplanned inspections, which could disrupt operations and increase costs.

To address these challenges, GFS implemented Eptura Asset, a comprehensive digital asset management solution. Because the goal was to enhance compliance and streamline their maintenance processes, they needed robust feature sets, including centralized record-keeping and user permissions management.

They implemented Eptura Asset to:

- Streamline the scheduling and tracking of 6,700 maintenance tasks, reducing delays and errors

- Manage the calibration of 140 pieces of measuring equipment, ensuring all equipment is calibrated on time and in compliance with industry standards

- Maintain employee credentials for various welding certifications, ensuring all tasks are completed by qualified personnel

The company has managed to cut its Inspection Selection System (ISS) rating in half, significantly reducing the risk of unplanned inspections and regulatory penalties. The centralized record-keeping and user permissions management features have further enhanced compliance, ensuring that all facilities are operating with and meeting the same standards.

By leveraging Eptura Asset, GFS demonstrated its commitment to safety and regulatory compliance, which is essential for maintaining a competitive edge in the oil and gas sector.

Read the complete customer success story.