For large organizations managing extensive corporate real estate (CRE) portfolios with facilities spread out over multiple locations, space delivers value critical to current stability and future growth. But corporate real estate (CRE) managers and space planners need to ensure an organization doesn’t have more space than it needs. And although tracking vacancy is important, it’s only one of many metrics companies need to track through intelligent worktech for efficient, effective space planning.

How does space management deliver value for companies?

For a large enterprise controlling an extensive real estate portfolio, space solves several strategic goals. Space gives them the room they need to operate, supplying staff with access to the assets and equipment they require to work effectively. But it can also be a way to invest capital over the long term.

Streamlined operations

Optimal layout is an important part of space planning. Well-designed spaces can enhance workflow and productivity by strategically locating departments and teams to facilitate collaboration and communication, improving day-to-day operations and ensuring that resources are used efficiently. Proper space planning can reduce waste and optimize the use of resources, leading to cost savings and improved operational efficiency.

Enhanced employee experience

A well-designed workspace can significantly improve employee comfort, reducing stress and enhancing overall well-being. When employees are comfortable, they are more likely to be productive. Spaces that are conducive to focus and collaboration can lead to increased productivity and job satisfaction, creating a positive work environment that benefits both the employees and the company.

Financial value

Real estate is a significant asset that can appreciate over time, contributing to the company’s overall financial health. Strategically located and well-managed properties can generate additional revenue through leasing or other commercial activities. This not only adds to the company’s bottom line but also provides a stable source of income that can be reinvested in the business.

Why is having too much space a problem for large companies?

For a large company, having too much commercial real estate (CRE) can present several issues beyond the obvious, higher than necessary operating costs. Mismanaged, space becomes an administrative and financial burden that robs the company of opportunities to invest and improve.

Capital investment

Acquiring too much CRE requires a substantial upfront capital investment, which the company could have better allocated to other strategic investments. And tying up capital in real estate can limit the company’s ability to invest in other growth opportunities, presenting a significant opportunity cost.

Management challenges

Managing a large and diverse real estate portfolio demands more administration, sinking significant time and resources. And spreading operations across too many locations can make it more difficult to maintain consistent standards and oversight, leading to decentralized and inefficient operations.

Diversification risks

Having too much CRE can lead to over-concentration in one asset class, increasing the company’s exposure to real estate-specific risks. A large CRE portfolio can disrupt the balance of the company’s overall asset portfolio, potentially affecting its risk-return profile and limiting diversification opportunities.

Why is vacancy as a workplace metric not enough when determining if you have the right amount of space?

In an office space, the vacancy rate simply measures the percentage of unassigned or empty workstations compared to the total number. Part of the problem with focusing too heavily on this rate is that it can fluctuate often, often from one day to the next.

In the modern office, the way employees work and use space has fundamentally changed. The days when an employee would be assigned to a cubicle, furnish it with a box of personal items, and then stay there for two decades are, for many companies, simply gone.

It’s more common for an employee to spend her morning working in a large, open space, move her laptop into a meeting room on another floor during the afternoon and end the day working in a nearby coffee shop. Many offices function like revolving doors with employees coming and going at all hours; in a recent Gallup survey, 49% of Americans said they have worked from outside a traditional office.

So, the traditional way of tracking vacancy or occupancy rates by counting heads once a month doesn’t account for this new trend. And it doesn’t help space planning professionals factor in organizational changes that cause shifts in space utilization, such as mergers or acquisitions.

So, while vacancy is a valuable metric for determining the right size for office space, relying solely on it has several limitations, including:

Context: Vacancy rates don’t provide insights into how space is used when it is occupied. For example, a space might be vacant during certain hours but heavily used during others. It can also miss peak usage factors, which are crucial for understanding true space requirements.

Qualitative factors: Vacancy rates don’t help workplace leaders account for employee satisfaction and comfort. A space might be fully utilized according to the data but still not meet the needs of the employees in terms of comfort, privacy, or collaboration.

Static nature: Vacancy rates provide a snapshot in time but don’t account for the dynamic nature of business needs. Companies may experience fluctuations in staffing, project requirements, or remote work policies that aren’t captured by static vacancy metrics.

Space efficiency: High occupancy doesn’t always equate to efficient use of space. Employees might be cramped, or the layout might be inefficient, leading to lower productivity.

Underutilized areas: Some areas might be consistently vacant due to poor design or location, rather than an overall surplus of space.

Vacancy is a useful metric, but space planning professionals should use it in conjunction with other metrics and qualitative assessments to get a comprehensive understanding of office space needs.

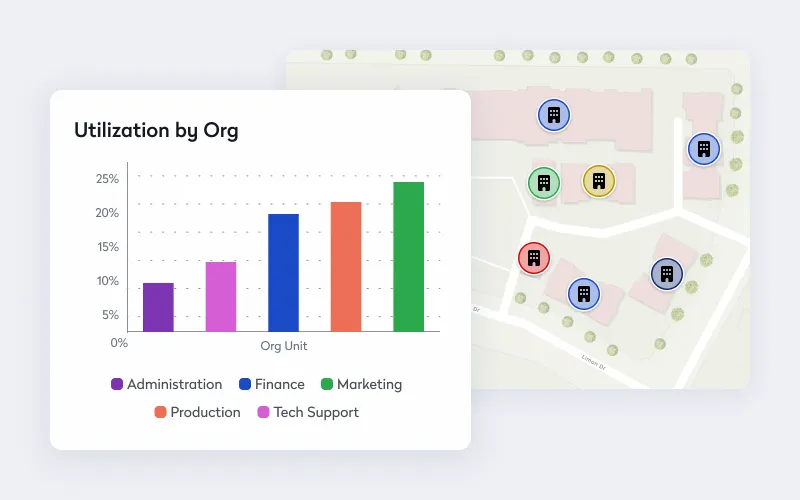

What are the space metrics large companies should be tracking?

When planning office space, companies need combinations of several metrics to make informed decisions.

Vacancy rate

Percentage of total office space that employees do not occupy or use

A high vacancy rate of 20% suggests that there is a significant amount of unused space. A company might decide to consolidate departments, sublet unused space, or reconfigure the layout to better utilize the available area. In cases where a larger company has space across multiple facilities in the same general area, they can consider moving departments from one building to another, but only after carefully considering how each department tends to collaborate with other teams.

Occupancy rate

Percentage of total office space employees occupy or use

If the occupancy rate is consistently above 90%, it might indicate that your office is nearing capacity. You could decide to expand the office space or implement flexible work arrangements to accommodate growth without overcrowding.

Space utilization rate

Percentage of time that employees use a specific space

If a meeting room has a utilization rate of only 30%, space planners might decide to repurpose it as a collaborative workspace or reduce the number of meeting rooms to optimize space usage.

Employee-to-space ratio

Number of square feet or square meters a company allocates per employee

If the industry standard is 150 square feet per employee and the current ratio is 200 square feet per employee, CRE professionals might decide to reconfigure the office layout to make more efficient use of space.

Peak occupancy

Maximum number of people using the space at any given time

If peak occupancy occurs during specific days of the week, a company might decide to implement staggered work hours or flexible work arrangements to distribute the load more evenly throughout the day. Companies can approach the current challenge of the midweek mountain, for example, with many different solutions.

Space efficiency

Ratio of usable space to total space, including common areas and circulation space

If space efficiency is low, space planners might decide to redesign the office layout to reduce wasted space and increase the amount of usable area.

Cost per square foot/meter

Cost of renting or maintaining office space per square foot or square meter

If the cost per square foot is high, a company could decide to negotiate a better lease, move to a more cost-effective location, or optimize the current space to reduce overall costs.

What is an example of a space management success story?

A multinational finance leader with over 150,000 employees across 70 countries faced significant challenges managing its extensive real estate portfolio. They suffered from underutilized spaces and the financial burden of maintaining multiple locations in different regions, including underutilized offices, data-deficient decisions, and spaces that did not match employee needs.

Eptura’s workplace management worktech was the solution, delivering:

- Advanced data: Space utilization data provided unprecedented insights into occupancy and employee space usage.

- Proactive booking: Users could book desks in advance, enhancing efficiency and flexibility

- Robust reporting capabilities: Meeting room check-ins and other features allowed for comprehensive data collection and analysis.

By leveraging advanced data analytics to gain deep insights into how spaces were occupied and used by employees, the company could proactively manage desk bookings and utilize robust reporting tools for better data collection and analysis.

By centralizing all employees into one building in a single country and removing an entire building from their portfolio, the company streamlined its operations and significantly reduced overhead costs. But they only knew these critical moves were possible once they had reliable data they could then leverage into actionable insights.

The organization achieved annual savings of €11 million ($13.8 million), primarily because of the reduced need for physical space and the associated costs of maintaining these areas.

Learn more about this space management success story.