How would you rate your current maintenance programs? Which ones are working well overall, and which specific assets and equipment could use more or a different type of attention? More importantly, how can you systematically and reliably answer these questions?

Replacement asset value (RAV) is the combined cost to replace your maintained assets, and it can be an important first step in accurately calculating how well the maintenance team is keeping everything up and running.

What is replacement asset value (RAV)?

RAV is the total cost to replace all the existing assets and equipment you maintain. You list everything the maintenance team looks after and then determine how much it would cost to replace it with identical equipment. A common definition of RAV involves a theoretical fire — RAV answers this question: if your manufacturing plant burnt to the ground, what would it cost to replace everything?

RAV can be an important number for the accounting and finance departments. But for maintenance professionals, RAV is valuable only as part of a simple calculation, the replacement asset value formula, which you can use to benchmark your maintenance program.

RAV versus other evaluation methods

In asset-heavy industries, Replacement Asset Value (RAV) offers a distinct approach to valuation, focusing on the cost of replacing an asset with a similar one at the end of its lifespan. Unlike market-based valuations, which assess an asset’s current selling price, RAV considers all costs needed to restore functionality, including repairs and updates.

This makes RAV particularly useful for planning around essential, high-value assets where operational continuity is crucial.

For instance, a manufacturing company relying on RAV can set funds aside to replace critical machinery before it fails, reducing downtime risks and maintaining productivity. RAV is also valuable in fast-evolving sectors like technology and healthcare, where frequent advancements demand forward-thinking replacements to maintain competitiveness.

With RAV, companies can budget for future upgrades, ensuring access to modern equipment without frequent, disruptive overhauls. This approach not only supports consistent performance but also helps businesses stay at the forefront of their industries.

What is the RAV formula and how do you calculate it?

The RAV formula, like RAV, is simple. You divide the total annual maintenance costs (MC) by the RAV and then multiply by 100. The result of the formula is a percentage.

The RAV formula = MC/RAV X 100

It’s why another common name for the formula is MC/RAV %.

How the RAV calculation works

If your maintenance costs for the year are $10,000 and your current RAV is $100,000, the MC/RAV is 10%. Another way to think about it is that it would take ten years to spend as much on maintenance as the asset is currently worth.

But there’s a bit of complexity hiding behind the calculation. Using the RAV formula is simple, but calculating RAV is not straightforward.

How should you calculate the RAV and MC for assets and equipment?

Carefully and consistently.

To get actionable insights into your maintenance program, you need an accurate RAV.

Start by finding all associated costs for an asset’s replacement, including:

- Procurement: Price, taxes, shipping

- Installation: Labor, renovations, expansions

- Training: Upskilling, testing

- Disposal: Removal, fees

When looking at price, factor in age. For a relatively new facility, use the capital costs plus annual inflation. If something cost you a million dollars three years ago, you need to add three years’ worth of inflation to see what replacement would cost in “today’s dollars.”

For older facilities, you must apply both depreciation and inflation to get your RAV. The good news is that the accounting or finance departments likely already have all these numbers.

Remember that your numbers age out of accuracy, and you can’t always rely on inflation and depreciation to update them. Instead, you need to go out periodically and check the current market prices.

An asset stops depreciating at a steady rate if the market introduces an innovation that renders older models obsolete. For instance, an asset losing only a few percentage points of value a year might suddenly drop if it lacks the efficiency or safety standards of newer offerings.

For example, your horse and buggy would depreciate at a slow and steady annual pace until cars became more reliable, widely available, and affordable. At that point, you would need to recalibrate your numbers. That buggy is suddenly worth much less than it was the year before.

Calculating MC follows the same basic steps. Take all the costs associated with maintenance, and add them up, including:

- Labor

- Parts and materials

- Preventive maintenance

- Repairs

- Troubleshooting and testing

On top of being careful when calculating MC and RAV, you also need to be consistent. Once you establish a system, you need to follow it. So, if last year you used an average hourly rate for the collective labor costs, you need to do the same thing this year.

It’s important to have numbers that are both accurate and precise. An accurate number of as close as possible to the actual value. Precise means your system for measuring tends to produce similar results.

Can you use your MC/RAV % as a world-class benchmark?

You can, but you have to be careful.

The commonly suggested target is your maintenance costs equal to 2% of the cost to replace your assets and equipment. So, if replacing your plant costs a million dollars, you should be spending $20,000 a year to maintain it. And at 2%, you get 50 years of maintenance before spending the value of your assets.

The challenge when using the replacement asset value formula, according to Ron Moore, BSME, MSME, MBA, PE, and CMRP, in an article for Asset Management Professionals is ensuring you’re not inadvertently comparing apples to oranges when looking at asset and maintenance costs across different industries.

So, in a lightly regulated industry, you might have lower maintenance costs simply because there are fewer inspection requirements involving expensive tools and training.

In a chemical plant, for example, your maintenance costs will always be generally higher than at a plastics factory. And the maintenance costs for aircraft, where reliability basically beats all other considerations, are higher than at a food processing plant.

“While there are similarities across many industries, the details of the design, operations, maintenance, capital cost, and regulatory environment, among other factors, make useful comparisons difficult,” he explains.

So, when using the RAV formula as an industry benchmark for your maintenance operations, make sure you’re looking specifically at maintenance in your industry, not the industry of maintenance.

Using RAV for data-driven decisions to control maintenance costs

You can do this but, again, you have to be careful. If you track your MC/RAV % annually, you can develop strategies to support or counteract trends.

If your MC/RAV % is increasing year over year, you know you need to find ways to cut costs, including:

- Focusing on preventive maintenance over on-demand

- Tracking parts and materials for better inventory control

- Offering training and upskilling for maintenance techs

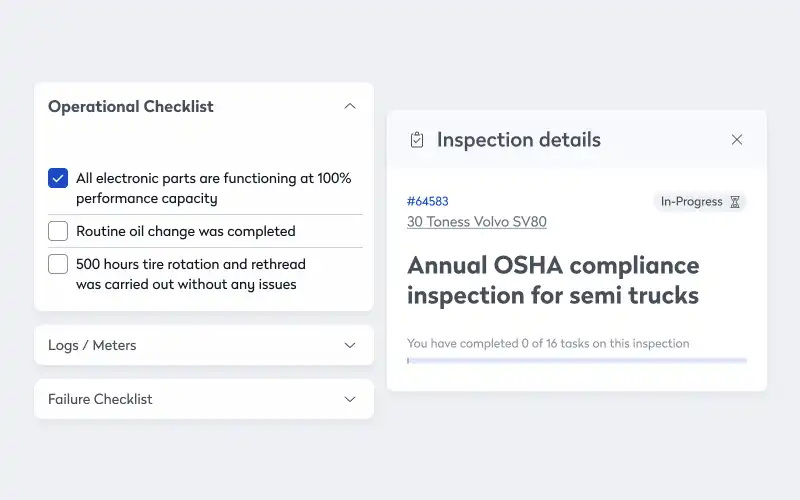

- Implementing an enterprise asset management solution

But just because your MC/RAV % is currently trending down, it doesn’t always mean you’re headed in the right direction. Remember, you can cut maintenance costs right now by doing less maintenance, including the inspections and tasks you should be doing to avoid trouble down the road, so on paper you’re saving money. It’s only later when it all comes back to bite you.

That’s why, as a rule, you need to see individual metrics inside the context of all your other maintenance metrics, Moore warns.

“All the measures are interrelated and impact each other… If you focus most of your energy on achieving a superior level of performance in one area, you will likely damage those in other areas and damage the overall performance of the business… You could drive down your spare parts inventory levels, only to not have them when needed, delaying maintenance and making it more expensive, and losing production and profits.”

You can also use MC/RAV % to help you make repair-or-replace decisions on a single asset. Remember, when you’re at 2%, it would take 50 years for the cost of maintenance to equal the replacement cost for an asset. But at 20%, it’s only five. Here, replacement makes a lot more sense.

Using RAV for informed maintenance decisions

Understanding and applying Replacement Asset Value (RAV) gives maintenance leaders a clear perspective on asset management costs, enabling data-driven decisions for maintenance budgeting and asset lifecycle management. When combined with strategic metrics like MC/RAV %, RAV provides actionable insights that guide resource allocation, preventive maintenance prioritization, and effective repair-or-replace strategies.

Learn more about how Eptura’s asset management software can empower your team to maximize maintenance efficiency and control costs.