Across the financial services market, companies are expecting to see more people in the office. Part of it is because of changes to remote and hybrid work policies. But there’s also going to be more employees overall. Financial services firms are the most likely to increase head count in the next five years when compared with all companies globally, according to recent research.

For portfolio and facility managers, that means there’s even more pressure to deliver a workplace that supports the employee and client experience while controlling costs and maintaining compliance. But by investing in the right modern worktech, they can get ahead of the trends.

Why is facility and corporate real estate management so important in the financial industry?

The financial services industry encompasses a wide range of businesses that manage and facilitate financial transactions and investments, including banks, investment firms, insurance companies, and asset management firms. These institutions provide essential services such as lending, savings, investment management, and risk mitigation. They play a crucial role in the global economy by channeling funds from savers to borrowers and managing financial risks.

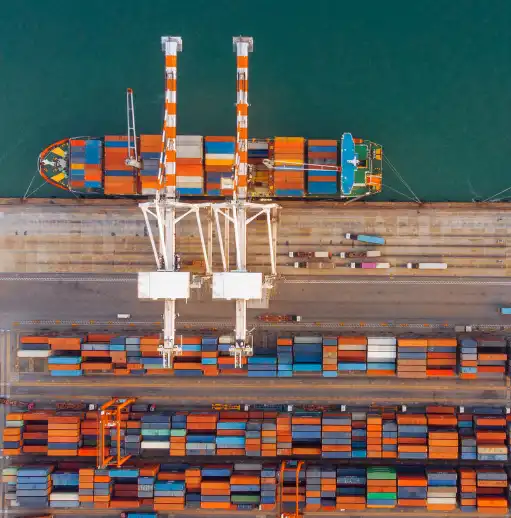

One of the key characteristics of the financial services industry is its internationalization. Many financial institutions operate on a global scale, with branches and operations in multiple countries, and their international presence allows them to serve a diverse client base and access various markets.

Another key characteristic is that many of these companies have to maintain prestige properties. One reason is that they want locations that convey a sense of success and stability to better attract clients. But just as important is the need to attract and retain top talent. In finance, the primary product is in many ways the people who perform the services, such as finance, consulting, and other professional services. Clients like to develop strong working relationships with the people looking after their investments, so they’re sensitive to any staffing changes. To help them attract and retain employees, companies invest in modern offices in desirable metropolitan areas.

So, not only do these organizations have to manage larger portfolios, but each location is more likely to be cost intensive if not carefully controlled.

What are the facility management challenges for the financial industry?

There are two basic categories of challenges. Some are directly related to regulatory compliance, while others stem from having to manage larger portfolios.

Regulatory requirements for security

In the financial services industry, physical security is a cornerstone of compliance and risk management. Financial institutions must implement robust physical security measures to protect sensitive data and assets that can include:

- Access controls: Implementing advanced access control systems, such as biometric scanners, keycards, and security badges, to restrict access to sensitive areas.

- Surveillance systems: Installing high-definition surveillance cameras and monitoring systems to deter and detect unauthorized access.

- Secure data centers: Designing and maintaining secure data centers with multiple layers of physical security, including reinforced walls, secure entry points, and environmental controls to protect against fire, water damage, and other hazards.

- Visitor management: Implementing a comprehensive visitor management system that includes background checks, visitor badges, and escorted access to sensitive areas, helping ensure all visitors are properly vetted and monitored.

Financial institutions must also carefully comply with regulations when implementing flexible work models, such as onsite, hybrid, and remote. For example, the Financial Industry Regulatory Authority (FINRA) recently provided more flexibility while ensuring regulatory compliance with changes to the Residential Supervisory Location (RSL) Rule and the Remote Inspections Pilot Program.

The RSL Rule allows member firms to treat a private residence where an associated person conducts specified supervisory activities as a non-branch location, reducing the frequency of required inspection to provide more flexibility for employees while maintaining regulatory standards. The Remote Inspections Pilot Program, on the other hand, enables eligible firms to fulfill their inspection obligations remotely, subject to specific terms.

Fragmented data and systems

Because every office location may have its own set of data and processes, there’s often a lack of standardization and consistency. Fragmentation creates data silos, where information is isolated and not easily accessible across different departments or locations. For instance, one office might use one platform software for space management, while another relies on spreadsheets, making it difficult for the organization to gain a comprehensive and accurate view of the entire real estate portfolio.

The lack of a centralized system can also lead to inefficiencies, as employees may spend a lot of time manually consolidating data from various sources.

Slow, labor-intensive manual processes

Manual processes and administrative tasks can be a major challenge for financial services companies in terms of facility management. When organizations have to rely on spreadsheets and other manual methods for tracking space usage, occupancy, and other critical data, the processes are not only time-consuming but also prone to errors. For example, updating occupancy data in multiple spreadsheets can be a tedious and error-prone task, especially when dealing with many employees and locations.

Administrative burdens divert valuable time and resources away from more strategic activities, such as strategic planning and employee engagement. Automating these processes can significantly reduce the time and effort required for data management, allowing facility managers to focus on more value-added tasks. It also improves the accuracy and reliability of the data, leading to better decision-making.

Lack of real-time data and insights into trends

The lack of real-time data and insights is a critical challenge for financial services companies in managing their real estate portfolios. Without up-to-date information, it is difficult to make informed decisions about space allocation, lease negotiations, and other strategic initiatives. For example, if a company does not have real-time data on space utilization, it may overestimate or underestimate the amount of space needed, leading to either underutilized or overcrowded offices. The result is higher operational costs and a worse employee experience.

What are the benefits of digital transformation for financial institutions?

By leveraging advanced technologies, organizations can create more efficient, secure, and user-friendly environments that support both operational excellence and regulatory compliance.

Supporting employee and visitor experience

One of the primary ways digital transformation enhances the employee and visitor experience is through the implementation of advanced visitor management systems.

These systems can automate the check-in process, reducing wait times and improving the overall visitor experience. For example, visitors can pre-register online, receive digital badges, and be directed to their meeting locations via mobile apps. This not only streamlines the process but also enhances security by providing real-time tracking and access control. Employees benefit from a more organized and professional environment, which can boost productivity and satisfaction.

Desk and room booking software is another critical tool in digital transformation because it supports and simplifies the process for employees to reserve workspaces and meeting rooms, ensuring that they have the necessary resources to perform their tasks effectively.

For financial services organizations with multiple locations, this technology can be particularly helpful. It enables employees to find and book spaces at different offices, fostering collaboration and flexibility. Additionally, the software can provide insights into space utilization, helping facility managers optimize the layout and reduce costs.

Capturing data for real-time improvements and insights into trends

IoT (Internet of Things) devices can also play a role in facility management. Companies can implement these devices to collect and analyze data on various aspects of the physical environment, such as temperature, lighting, and occupancy levels. For example, smart thermostats can adjust the temperature based on occupancy, while smart lighting systems can optimize lighting levels to reduce energy consumption. In multi-location organizations, IoT devices can provide a unified view of facility conditions, enabling centralized management and quicker response to issues.

Data management and integration are crucial components of digital transformation in facility management. By connecting data from various sources, such as visitor management systems, desk booking software, and IoT devices, organizations can gain a comprehensive understanding of their facilities’ performance.

Companies can use this integrated data to identify trends, predict maintenance needs, and optimize resource allocation. For example, data analytics can reveal patterns in space usage, helping facility managers make informed decisions about office layouts and resource allocation. In a multi-location setting, this data can be aggregated to provide a holistic view of the organization’s facilities, enabling more strategic and efficient management.

Customer success story: Financial services company grows and goes digital

Bank of Montreal (BMO) is a leading financial institution with a significant presence across North America. As part of their ongoing digital transformation, BMO embarked on a comprehensive worktech integration project to enhance corporate real estate management and employee productivity.

BMO faced several challenges in managing their extensive corporate real estate portfolio. With over 4,500 employees spread across 50 office locations, the bank struggled with fragmented data and manual processes. The lack of a centralized system for space and occupancy planning led to inefficiencies and higher operational costs. There was a critical need for accurate, real-time data to support strategic decision-making, but the existing systems were unable to provide this level of insight.

BMO partnered with Eptura to implement a new platform. The primary goal was to consolidate portfolio drawings and occupancy data into a single, reliable source. By centralizing data, BMO knew it could improve workspace utilization, reduce costs, and enhance the overall employee experience. The platform was chosen for its robust capabilities in space planning, which would enable BMO to make data-driven decisions and optimize their real estate portfolio.

The project has resulted in a single source of truth for space and occupancy data, streamlining the planning process and reducing the time required for data management. BMO has seen improvements in workspace utilization because the platform empowers space planners and facility managers to more efficiently allocate resources. The elimination of multiple systems and manual processes cut costs by reducing operational inefficiencies.

And the new digital solution has created a solid foundation for continuous improvement, allowing BMO to expand its worktech capabilities and support long-term strategic goals.