From the adoption of single solutions to the integration of a comprehensive platform, the path to digital transformation is rarely a straight line. In fact, as corporate real estate (CRE) consultants, we see many factors affecting how companies integrate new technologies. Despite these differences, many companies face the same central challenge. Companies need to find ways to capture more data while avoiding the temptation to treat all data as equally valuable.

Many factors affect digital transformation

Digital transformation has an overall direction and clearly marked milestones. Stage 1 means moving from manual tasks to a single point digital solution. Here, companies might implement a visitor management platform, transitioning from manual visitor check-ins. At Stage 2 they add more solutions, but usually all from one vendor. The advantage is that they’re able to streamline management and software costs. But because the solutions are disconnected, the data remains siloed.

It isn’t until Stage 3 when companies move to a single platform that they can implement integrated use cases, creating operational value through cross-platform functionality and digital mapping. Finally, at Stage 4, companies can leverage an integrated ecosystem for real-time predictive analytics for their facilities and assets.

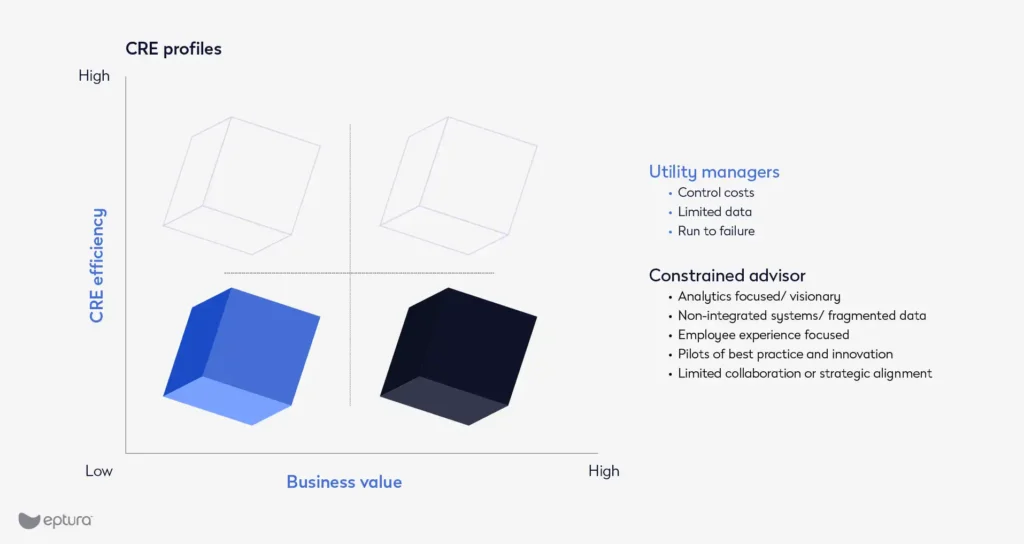

However, digital transformation is about more than just adopting technology. Just as important as the technology they have is how companies think about their CRE and assets. Traditionally, many companies saw their real-estate portfolio as a utility. So, the goals were limited to keeping the facilities running while controlling costs. But with advances in digital technologies and an expanded CRE agenda, many companies see their portfolio as an opportunity to drive value, helping them highlight the brand, attract and retain talent, and support connection and collaboration for their employees.

Scale plays a part

Another important influence we see is scale, especially when it comes to how much data companies want or think they need. At organizations with smaller, single spaces, it’s easier to have a better sense of occupancy and utilization rates. When everyone works in the same small space, an office manager can walk through the office to see how many people there are in the office.

At larger companies, though, where many of the functions are divided between teams, we see data silos. There might be a team for leasing, one for space planning, and another for employee experience, each with its own sets of policies and procedures, supported by different, disconnected software. Although each team closely examines the data it collects, the company lacks a comprehensive view of the big picture.

Not all large companies are the same shape, though, and in our experience some ownership structures bring new sets of challenges. At companies owned by holding companies, for example, attempts at widescale transformation can be more difficult because of the diversity between subsidiaries, varied corporate cultures, complex decision-making processes, and competing priorities.

Company culture and industry affect how organizations approach digital transformation

Although most can see the benefits of embracing digital solutions, not every company wants to be on the cutting edge.

In some cases, it’s because of company culture. Some companies are more conservative in their approach. When thinking about the digital journey, they prefer to use industry benchmarks to guide decisions on how and when to introduce new technologies. In many cases, this comes from a desire to minimize risk and ensure that any technology they implement has a proven track record within their industry.

The relative importance of attracting and retaining talent can also be a factor. A manufacturing plant in a low-cost-of-living area, for example, doesn’t see itself as being in competition for employees, so it’s less likely to implement worktech focused on improving the employee experience. Instead, when the company thinks about digital transformation, it’s tied to their assets and equipment. For example, they would be more interested in implementing condition-based or predictive maintenance on the production line.

That’s different than in industries where the primary product is the people who perform the services, such as finance and consulting. When clients make choices based on the expertise and service quality provided by employees, firms are in direct competition for talent, which motivates them to invest in spaces and software that improve the employee and visitor experience. Here, there’s more interest in visitor management systems, desk booking, and room reservations.

“Constrained advisors” and limited data are the common denominators

We see “constrained advisors” at many companies. Although they want to be more strategic by implementing digital solutions, they’re held back by a lack of data and integration.

For example, we were working with a company that was interested in adding sensors to track occupancy. But before they could do that, they first needed to rebuild some of the basics, including implementing a single definition of square footage across their portfolio. Another recent example: A large, multi-facility organization had different types and depths of data for each location. So, they might have been able to implement everything they want to at one location, but they couldn’t easily scale their success.

Limited data also creates current and future problems, especially for companies hoping to embrace artificial intelligence (AI). We’re seeing companies refocus on capturing good data, and we recently worked with a company that’s taking a close, hard look at their data, where it’s coming from and how much they can trust it. They know it’s a critical first step for future AI implementations.

The solution to limited data is not unlimited data

Knowing you need data is not the same as knowing what data you need. Ideally, digital transformation starts with a company asking itself which problems it wants to solve. From there, it can determine the data it should capture. But that’s not what we’re always seeing.

Point vs platform

Many companies introduced point solutions because of the pandemic. While some of them were effective in the short term, they often lacked the comprehensive approach needed for long-term success. Single solutions typically address one specific problem, so they can’t provide a holistic view. And it doesn’t matter how many a company implements. In fact, we’ve talked to companies with ten to 15 stand-alone solutions that still struggle to turn data into actionable insights.

For example, we spoke with a company that conducted an employee survey asking people how often they planned to come into the office. The survey results showed that employees planned to come into the office more frequently than what the company eventually saw in the access control data, desk bookings, and occupancy data. The survey data alone provided an incomplete picture, while the combination of multiple data sources in one system provided the only accurate understanding of employee behavior.

Project vs program

Companies that treat data as a project often end up with large data sets from multiple sources but a single period. So, what they have is only a snapshot of an aspect of their operations. And even though it captures a lot of the fine details, they can’t use it to see trends, which is where so much of the value of data lives. Knowing everything about the people who were in the office in the first week of February, including occupancy numbers, utilization rates, desk bookings, and room reservations, is likely less valuable than a narrower data set over a longer period. Because it’s data over time that reveals trends, data capture must be part of an ongoing program.

For example, six months of occupancy numbers reveal the busiest days of the week, which the maintenance team can use to schedule work when there are likely to be fewer people in the office. Janitorial staff could also use this data, scheduling work to best match the busiest times. Looking at patterns in room booking data can help space planners better match the office layout to employee needs.

Mainstream vs other companies’ metrics

For external benchmarking, there are some metrics that will always make sense in CRE, and companies should use them in their decision-making processes. For example, it’s important to understand the local market rates when looking for new spaces to negotiate a lease. Paying a fair price starts with knowing what something is worth.

But we’ve seen examples of companies trying to use external data without accounting for all the variables that can significantly impact these metrics. When benchmarking square feet per employee, for example, companies are likely to overlook all the reasons why the numbers are different, including everything from company culture to office layouts.

Companies can benefit from comparing how they were using spaces across facilities in their own portfolios. By focusing on internal data, they can gain a more accurate and actionable understanding of their own operations. For instance, comparing the utilization rates of different office locations or the effectiveness of various workspace layouts can provide valuable insights that are directly applicable to their specific context. And there’s an additional benefit for employee satisfaction. By benchmarking their facilities, companies can ensure a consistent look, feel, and culture at every office, so employees don’t feel one location is better than another.

The path to digital transformation is your own

What this all means is that there’s no one-size-fits-all path for digital transformation. Every organization needs to chart its own course based on a solid understanding of the problems it wants to solve, the data it needs to capture, and the technology it should implement.

To begin your own digital journey, connect with our consultancy.

Erik Zink, Vice President Worktech Consultancy and Corporate Development, has more than a decade of experience as a strategy and transformation consultant. He is an expert on change and strategic growth and has advised Fortune 500 enterprise leaders on large scale implementations and transformations.

Sarah Kilmartin, Director of Customer Insights, has more than two decades of experience managing enterprise customers and supporting global departments through workplace transformations. As a former facility and operations leader for a leading flex space provider, she’s an expert on workplace strategy, qualitative and quantitative thought leadership, and customer insight.